Good financial habits, like most good habits are rooted in childhood. Unfortunately, teaching children about money is not something that all of us do consciously in an organized manner. We may take financial literacy for granted, but we live in a consumerist and unsure world where it is important to be equipped with sound financial skills.

Teaching children about money

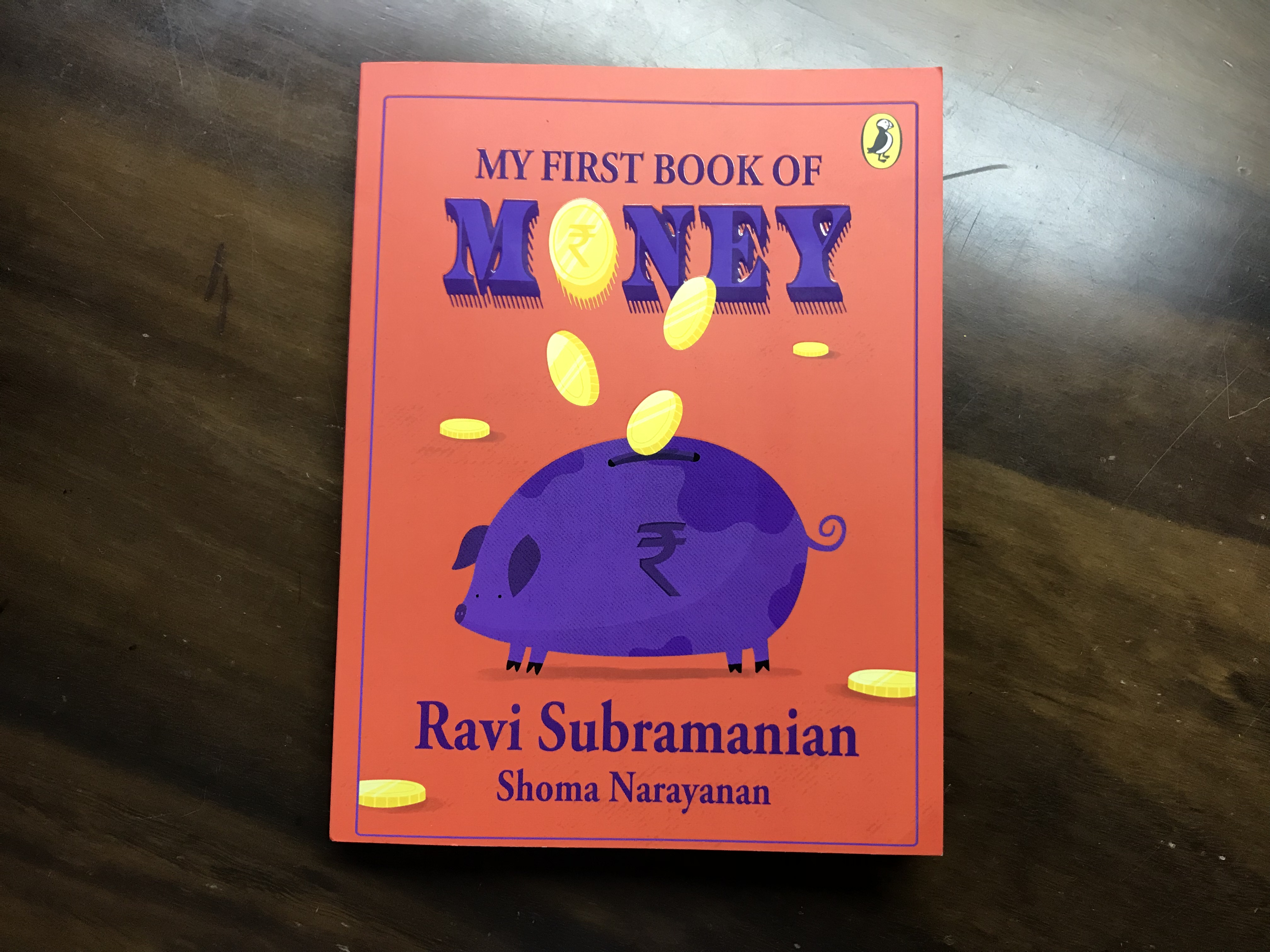

How much does your child know about money? My first book of money by Ravi Subramanian and Shoma Narayanan talks about money specifically in the Indian context. In short, look at it like a sort of guide to financial literacy for children.

The money story

The authors approach the task of dispelling financial knowledge in a manner that children connect to the most – a story. So here’s the way the narrative progresses- twins Aman and Anya are visiting their grandparents. A small incident related to paying the milkman sparks off a discussion on money.

From barter to digitalization

The book starts with explaining the concept of barter system and the evolution of money. It ends with the idea of digitalization. Well, the rest of the book contains everything in between!

Values and practicality

As the story progresses one can see that the information about money is either linked to ‘values’ or ‘facts’. This balance is really important. After all, what’s the sense in having knowledge if one can’t use it in the right way?

Some of the value based concepts the book purports include judging how much money one really needs, the difference between needs and wants, the importance of planning expenditures, not spending more than you have and setting money aside for charity.

Of course, the practical knowledge expressed in the book is vast and some of the key points include knowing about the concepts of banking, ATM, banking transactions, currency exchanges, loans and savings, deposits, credit cards, investments, interest and so on. There is an entire chapter devoted to demonetization and mobile wallets. The chapter on inflation and investment simplifies these concepts for children and teenagers.

Ready for some Financial exercises?

Teaching children about money must entail practical experience. At the end of each chapter there is a well thought-out exercise which reinforces the concept illuminated in the chapter. This exercise is best carried out with an adult in tow!

When it comes to the story of money and its evolution there are some pretty interesting facts to share. The book has these facts neatly boxed and these make for some interesting side reading as well.

There are some vivid illustrations by Bombay Design House that add to the element of interest.

The book is aimed at the 9 – 14 age group. However, in order to make it an interactive experience, we feel it’s best read with an adult. If you’re looking at teaching children about money, this book is an apt start.

Title: My first book of money

Authors: Ravi Subramanian and Shoma Narayanan

Reading level: 9 – 14 years

Publisher: Penguin Random House India, 2017

Language: English